4+ pages cut government spending on social programs and lowered income taxes 725kb solution in Doc format. Lowering income tax drove down prices greatly. Reduce spending and less government money would. A reduction in income taxes for individuals of 400 800 for couples 14. Read also programs and cut government spending on social programs and lowered income taxes He cut the corporate tax rate from 46 to 34.

His ideas were unconventional in the early 1980s. Tried to claim the mantle of fiscal responsibility stating This isnt going to be anything like my predecessor whose unpaid.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

| Title: How Does The Deduction For State And Local Taxes Work Tax Policy Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: Google Sheet |

| Number of Views: 3330+ times |

| Number of Pages: 203+ pages |

| Publication Date: November 2018 |

| Document Size: 2.1mb |

| Read How Does The Deduction For State And Local Taxes Work Tax Policy Center |

|

Bush when campaigning in 1980 for the Republican presidential nomination called Reagans ideas voodoo economics.

The president believed he could encourage strong economic growth reduce inflation increase defense spending and balance the budget while cutting taxes and reducing social welfare programs. Another eight states have implemented broad percentage-based reductions in agency budgets that include agencies serving low-income populations. Keeping taxes low for individuals is rightly a key priority for a taxpayer-focused budget. All households can claim a standard deduction to reduce their taxable income and many families with children can offset income taxes with the child tax credit. The tax burdens of France Germany and the United Kingdom are 419 percent 37 percent and 343 percent respectively. Among these states 17 have cut health care programs ten have cut income support or employment support programs such as child care and job training and 17 have cut other social service programs.

How Do Marginal Ine Tax Rates Work And What If We Increased Them

| Title: How Do Marginal Ine Tax Rates Work And What If We Increased Them Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: Google Sheet |

| Number of Views: 8211+ times |

| Number of Pages: 180+ pages |

| Publication Date: August 2018 |

| Document Size: 800kb |

| Read How Do Marginal Ine Tax Rates Work And What If We Increased Them |

|

Taxing The Rich Econofact

| Title: Taxing The Rich Econofact Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: PDF |

| Number of Views: 3310+ times |

| Number of Pages: 13+ pages |

| Publication Date: September 2021 |

| Document Size: 800kb |

| Read Taxing The Rich Econofact |

|

How Do Taxes Affect Ine Inequality Tax Policy Center

| Title: How Do Taxes Affect Ine Inequality Tax Policy Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: Google Sheet |

| Number of Views: 8129+ times |

| Number of Pages: 332+ pages |

| Publication Date: December 2019 |

| Document Size: 2.2mb |

| Read How Do Taxes Affect Ine Inequality Tax Policy Center |

|

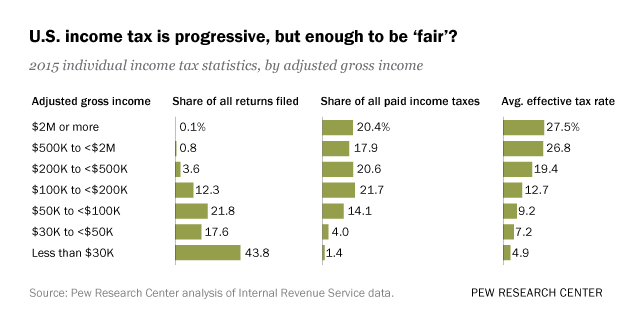

Who Pays U S Ine Tax And How Much Pew Research Center

| Title: Who Pays U S Ine Tax And How Much Pew Research Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: PDF |

| Number of Views: 8144+ times |

| Number of Pages: 75+ pages |

| Publication Date: December 2020 |

| Document Size: 2.2mb |

| Read Who Pays U S Ine Tax And How Much Pew Research Center |

|

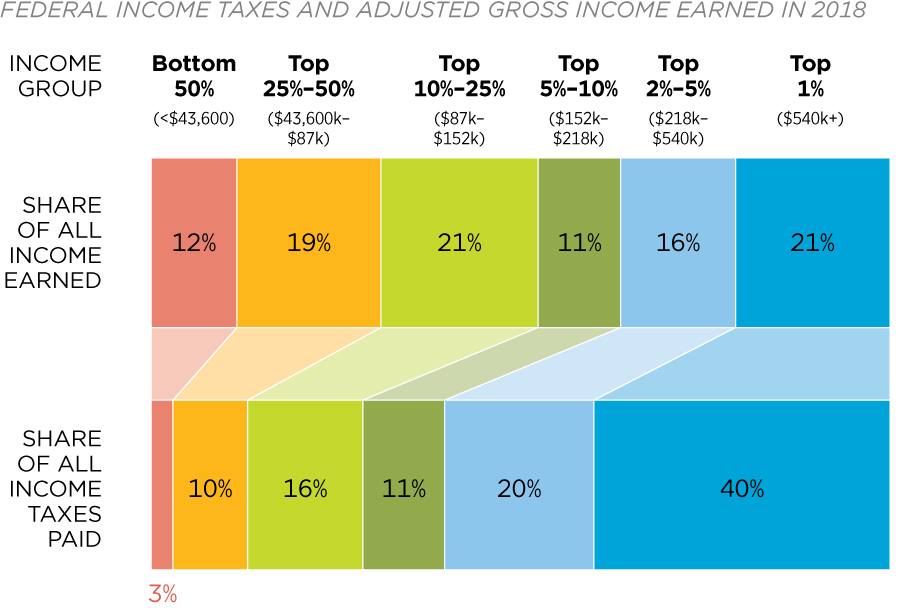

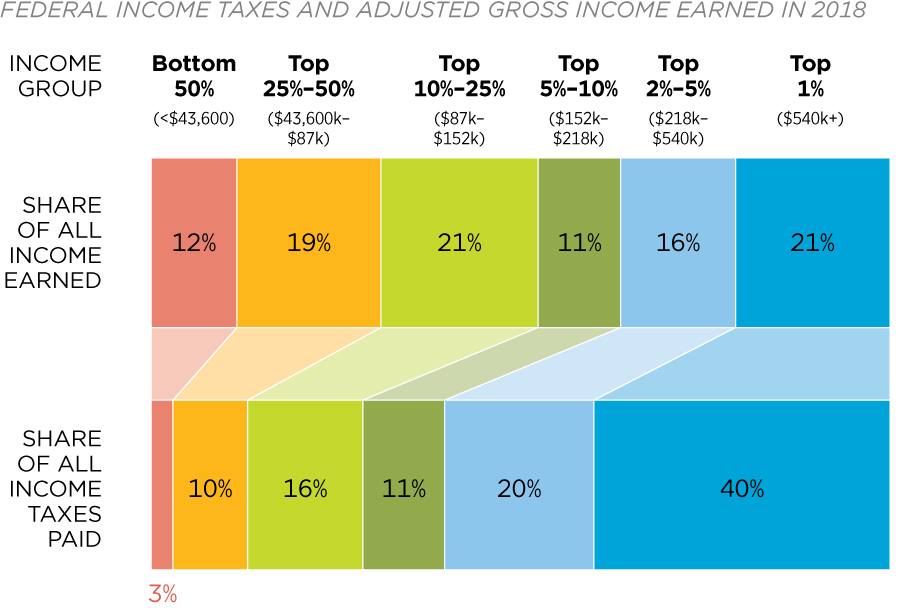

Do The Rich Pay Their Fair Share Federal Budget In Pictures

| Title: Do The Rich Pay Their Fair Share Federal Budget In Pictures Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: PDF |

| Number of Views: 8192+ times |

| Number of Pages: 50+ pages |

| Publication Date: July 2018 |

| Document Size: 1.2mb |

| Read Do The Rich Pay Their Fair Share Federal Budget In Pictures |

|

What Is The Tax Expenditure Budget Tax Policy Center

| Title: What Is The Tax Expenditure Budget Tax Policy Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: PDF |

| Number of Views: 3460+ times |

| Number of Pages: 143+ pages |

| Publication Date: April 2019 |

| Document Size: 1.9mb |

| Read What Is The Tax Expenditure Budget Tax Policy Center |

|

Who Pays U S Ine Tax And How Much Pew Research Center

| Title: Who Pays U S Ine Tax And How Much Pew Research Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: PDF |

| Number of Views: 5150+ times |

| Number of Pages: 348+ pages |

| Publication Date: July 2018 |

| Document Size: 3.4mb |

| Read Who Pays U S Ine Tax And How Much Pew Research Center |

|

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

| Title: The Distribution Of Tax And Spending Policies In The United States Tax Foundation Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: Doc |

| Number of Views: 8155+ times |

| Number of Pages: 337+ pages |

| Publication Date: January 2019 |

| Document Size: 2.3mb |

| Read The Distribution Of Tax And Spending Policies In The United States Tax Foundation |

|

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

| Title: The Distribution Of Tax And Spending Policies In The United States Tax Foundation Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: Doc |

| Number of Views: 9195+ times |

| Number of Pages: 312+ pages |

| Publication Date: October 2017 |

| Document Size: 3mb |

| Read The Distribution Of Tax And Spending Policies In The United States Tax Foundation |

|

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

| Title: What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: Doc |

| Number of Views: 9188+ times |

| Number of Pages: 261+ pages |

| Publication Date: April 2018 |

| Document Size: 1.35mb |

| Read What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center |

|

How Do Taxes Affect Ine Inequality Tax Policy Center

| Title: How Do Taxes Affect Ine Inequality Tax Policy Center Cut Government Spending On Social Programs And Lowered Income Taxes |

| Format: PDF |

| Number of Views: 3050+ times |

| Number of Pages: 170+ pages |

| Publication Date: April 2020 |

| Document Size: 2.3mb |

| Read How Do Taxes Affect Ine Inequality Tax Policy Center |

|

Download FISCAL FACT No. Third the proposed 10 percent across-the-board cut in income tax rates would require using about 200 billion of the social security trust fund to finance general tax cuts. Keeping taxes low for individuals is rightly a key priority for a taxpayer-focused budget.

Here is all you need to know about cut government spending on social programs and lowered income taxes By extending the individual tax cuts from 2017 the budget would cut taxes by 14 trillion. He promised to slow the growth of government spending and to deregulate business industries. Our second finding is that reductions in entitlement programs and other government transfers were less harmful to growth than tax increases. Who pays u s ine tax and how much pew research center how does the deduction for state and local taxes work tax policy center how do marginal ine tax rates work and what if we increased them do the rich pay their fair share federal budget in pictures the distribution of tax and spending policies in the united states tax foundation what are tax credits and how do they differ from tax deductions tax policy center That figure includes deep cuts to Medicaid and premium tax credits that help individuals purchase coverage in the Affordable Care Act marketplaces as well as cuts to programs such as SNAP Temporary Assistance for Needy Families TANF the Social Services Block Grant and Supplemental Security Income which provides income assistance to low-income people with disabilities and low-income.